“Retaliatory” Tariffs Cast Cloud Over Bourbon Forecast

It’s time for our annual look at the state of the union in the bourbon industry. If this year’s outlook was a weather forecast, it might say, “Partly cloudy with a great chance of damaging tariffs.”

Whiskey industry media outlets ended the year with a few sobering headlines like these:

MGP Ingredients CEO steps down as sales and stock prices drop, and inventory increases

Kentucky Owl Bourbon parent company files for bankruptcy

Diageo Puts Plans for New Distillery on Hold

Looming Tariffs Threaten Record Bourbon Production and Landmark Barrel Inventories

In general, sales are down, while production and supplies are up. As you know, bourbon can be made anywhere, but 95% of it comes from Kentucky. As goes the Bluegrass, so goes the rest of the bourbon industry.

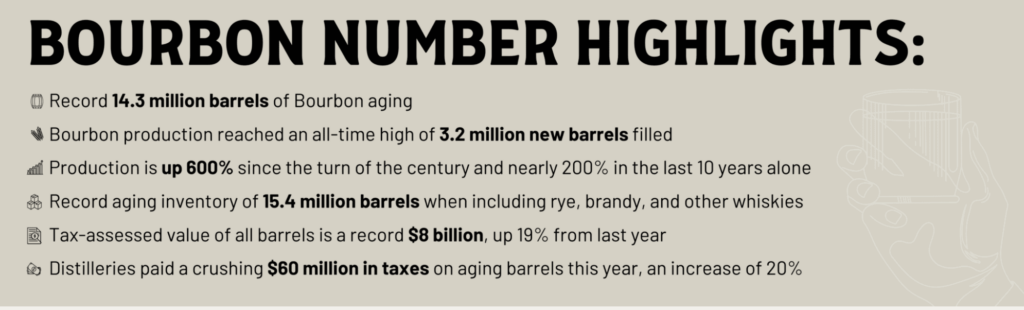

Here’s the lead from this year’s annual Kentucky Distiller’s Association (KDA) report on The Bourbon State: “The looming return of retaliatory tariffs on American whiskey is threatening the unprecedented growth of the Commonwealth’s signature distilling industry, which is now aging a record 14.3 million barrels of bourbon.”

The good news: “Bourbon continues to drive Kentucky’s economy as our homegrown industry is generating more jobs, more payroll, more tax revenue, more tourists and more distilleries in more counties than ever before,” said Eric Gregory, President of the Kentucky Distillers’ Association.

The bad news: “But we are up against a triple threat of back-breaking tariffs, snowballing taxes and shifts in consumer trends that have slowed sales,” Gregory continued. “If tariffs targeting American Whiskey are levied, distillery workers, farmers, truckers, coopers, hospitality staff and entire industries that depend on bourbon will suffer.”

The KDA said, “The European Union is set to reinstate tariffs on exports of American spirits at a crippling 50% rate in March if nothing is done. Retaliatory tariffs from the E.U. and other countries have cost Kentucky Bourbon a half-billion dollars in exports since 2018.”

Kentucky distillers have to pay a property tax each year on every barrel of whiskey as it sits aging in a rickhouse. Local governments in Kentucky use those barrel taxes to fund a lot of police, fire, EMS, and school services.

Good news for the bourbon industry came in 2023 when the Kentucky Legislature passed House Bill 5 into law to phase out barrel taxes over the next 20 years. As KDA President Eric Gregory said, “…to reign in the ever-growing discriminatory barrel tax.”

“With an eye on building a strong Kentucky for generations to come, we are grateful that the pro-growth Kentucky General Assembly passed House Bill 5 to put our signature Bourbon industry on a level playing field with all other states and countries that do not levy such a discriminatory fee,” said Ashli Watts, President of the Kentucky Chamber of Commerce.

Kentucky 2024 Bourbon Quick Facts

23,100 Jobs

$1.63 Billion Payroll

$9 + Billion Economic and Tourism Impact

300 % Production Increase

14.3 Million Barrels Aging

$375 Million State and Local Taxes Paid

$1.9 Billion in Federal Alcohol Taxes Paid

2.5 Million Distillery Visits in 2023

Source: Kentucky Distillers’ Association

“It’s no secret that our industry is experiencing a slowdown in sales and still working to recover from the pandemic and the last round of tariffs. We are clawing back, but all these challenges are real and come with success.”

Eric Gregory, KDA President

That’s a quick look at the current economic state of the bourbon union. For a look ahead to what we might expect in the new year, I turned to a few of my fellow Whiskey Network staff writers. Read their 2025 whiskey prognostications below.

Here’s wishing you a wonderful new year of bourbon drinking and reading.

2025 Prognostications: Inflation triggers lower demand

Daniel Rundquist, Whiskey Network Staff Writer

We enter into 2025 at a time when demand for spirits has softened considerably while at the same time stocks and supply had never been higher. Distillers are now facing a precarious balance between attempting to stabilize sales while preventing a collapse in margin due to reduced price points. Reducing the number of SKU’s and trimming back unprofitable lines are two ways that a distiller might gain some ground on efficiency during this time. The majors should be able to navigate this market safely and weather the storm, but for the smaller distillers and the NDP’s (non distilling producers) — their strategies may have to be more creative to survive. They may only have one line and there is little to trim.

While it is clear now that the consumer is feeling the full force of massive monetary inflation across so many other categories, their disposable income has shrunk considerably. This, of course, affects their purchasing decisions and spending priorities. Liquor is a less important spend than groceries and gasoline, so whiskey consumers are now polarizing towards two subcategories: the $30 and under expressions, and the super-premium over $100 brands segment. This leaves the once comfortably competitive mid-tier expressions say, $30 -$100, a bit out in the cold.

This is not all gloom and doom, though. With the cost of energy somewhat stabilizing, even decreasing in some sectors, the cost of production and transportation could also stabilize a bit. This might translate into stabilizing prices, where we have been accustomed to constant price increases over the past few years. With the present glut of supply and weakening demand, there will be even more pressure on lowering prices. While it’s unlikely that we will see a unilateral price cut across every brand, anything is possible. I look for the most price pressure in that mid-tier as those brands attempt to maintain unit movement, with perhaps deeper and more frequent promotional activity.

2025 Prognostications:

Correction in the Cask Market

Nate Barlow, Whiskey Network Staff Writer

2025 Prognostications:

Cooling Marketplace, Moderate Acquisitions

Mark Pruett, Whiskey Network Editor-in-Chief

My predictions for 2025. It’s going to be an interesting year! There’s a lot already unfolding and it’s just a few days into January.

First, while there will be an overall cooling of the whiskey marketplace, this will be mitigated by larger brands investing more in traditional marketing outlets. Non-traditional marketing outlets will likely see less activity in the first half with potential for return in the second. Expect 2025 targets to be relatively conservative and media outlets to be well scrutinized for their return on investment.

Next, the second quarter will likely see moderate acquisition activity. Top-tier independents are all fair game in the marketplace as “big whiskey” will adopt a grow by acquisition strategy. Activity could be sooner or later, depending on first quarter performance.

Finally, there will be considerable risk in the small NDP (non-distilling producers) marketplace for whiskey. As bigger brands look to bolster market share with traditional marketing spend, more consumer dollars are anticipated to flow in their direction. The year will likely see several high profile but very small NDP’s in trouble.

Buckle up, everyone! It’s going to be an interesting year!

About the Kentucky Distillers' Association

(From the KDA) Founded in 1880, the Kentucky Distillers’ Association is the legendary voice for Kentucky’s signature Bourbon and distilled spirits industry. Its diverse and growing membership produces the overwhelming majority of the world’s Bourbon, from historic, global brands to emerging micro distilleries that are fostering the next generation of the Commonwealth’s landmark economic engine and its thriving, timeless craft. Member benefits include media relations, international trade development, private sampling events, technical assistance, economic development support, networking, legal defense, marketing strategies, governmental and regulatory advocacy and innovative tourism experiences through the KDA’s world-famous Kentucky Bourbon Trail® and Kentucky Bourbon Trail Craft Tour® adventures. A 501(c)(6) nonprofit organization, the KDA maintains an open membership policy, champions a strong commitment to the responsible and moderate consumption of spirits, and fights to curb underage drinking and drunk driving. Learn more at www.kybourbon.com and www.kybourbontrail.com.

Colonel Brian G. Miller is the Editor of Whiskey Network Magazine. His column, The Bourbon Tutor, covers the latest in bourbon tourism, events, culture, and history. He lives in Louisville, Kentucky. You can reach him at [email protected]